The UK automotive landscape has crossed a line

The UK did not just “move towards” electric in 2025. It stepped over the threshold. As we pull into 2026, the latest figures from the Society of Motor Manufacturers and Traders (SMMT) confirm what you can already see at junctions, school runs, and motorway services: battery electric vehicles have stopped being a niche choice and started behaving like a default.

December was the moment it became impossible to dismiss as a trend. It was a statement.

December 2025: 32.2% market share for BEVs

In the final month of 2025, battery electric vehicles (BEVs) took 32.2% of all new car registrations. That is effectively one in three cars registered in December requiring a plug, not a pump. The volume behind that share is just as eye-opening: 47,139 new BEVs registered in December alone. SMMT (6 Jan 2026): December and 2025 registration tables

SMMT also notes that December was the only month in 2025 where BEVs exceeded the UK’s ZEV mandate target for the year, which helps explain the end-of-year surge. It is still a milestone worth taking seriously, because it reflects real-world availability, real-world pricing dynamics, and real-world buyer confidence, all arriving at once. SMMT commentary on mandate and December uplift

Full-year 2025: nearly half a million new electric cars

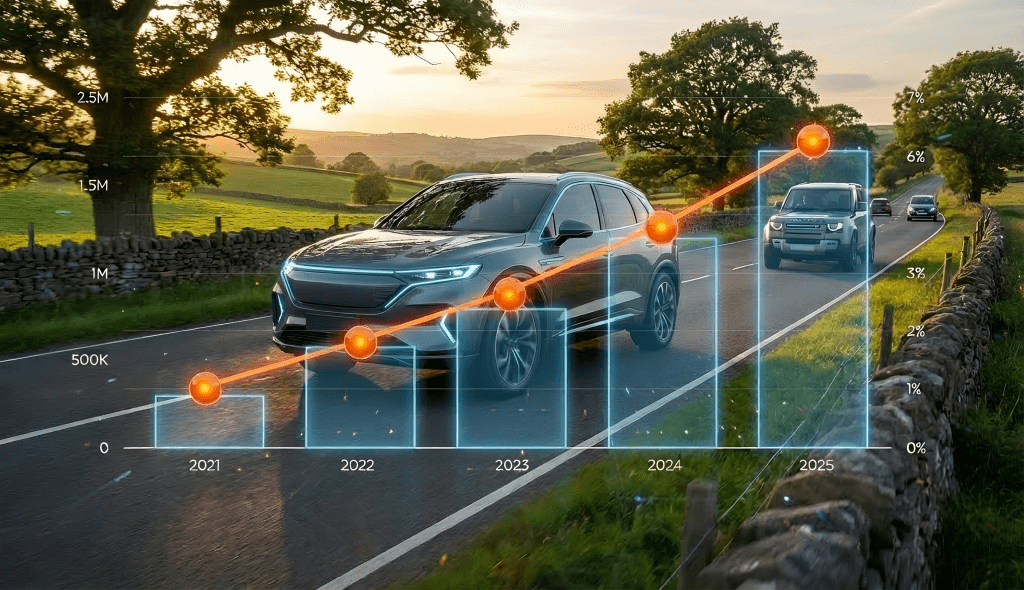

The December headline is dramatic, but the year as a whole is the deeper story. Across 2025, the UK registered 473,348 new BEVs, taking BEVs to a 23.4% annual market share. In plain terms, nearly a quarter of all new cars sold last year were fully electric. SMMT (6 Jan 2026): year-to-date BEV registrations and market share

The growth versus 2024 is equally clear in the SMMT tables: BEV registrations rose from 381,970 (2024) to 473,348 (2025), an increase of 91,378 vehicles year on year. SMMT tables: 2025 vs 2024 BEV volumes

Another detail that should make you pause: SMMT highlights that 2025’s BEV volume was more than the whole of 2021 and 2022 combined. That is what acceleration looks like. SMMT statement on 2021–2022 comparison

Why did adoption surge in 2025?

No single cause explains a shift of this size. 2025 was a convergence year: policy pressure, product availability, and charging reality all improved at the same time.

- The ZEV mandate effect: The regulatory trajectory pushed manufacturers to prioritise electric registrations, creating more supply, sharper offers, and heavier end-of-year delivery momentum. SMMT notes on mandate gap and market dynamics

- More choice than ever: SMMT points to a growing model range, with more than 160 BEV models available and more expected in 2026, which matters because mainstream buyers want normal choices, not compromises. SMMT commentary on BEV model availability

- Confidence through infrastructure familiarity: While charging is still the number one friction point for many drivers, the everyday visibility of rapid hubs, workplace charging, and on-street solutions has reduced the “unknown” factor compared with even two years ago.

- The experience layer: Drivers increasingly expect charging to feel organised: clear pricing, live status, and simple payment. That is exactly the gap ONEEV is built to close, by helping drivers quickly find the right charger and make confident decisions before they arrive. ONEEV

What this means for the UK charging network

Nearly half a million new BEVs in one year is not just a market win. It is a behaviour change that forces the ecosystem to mature. The question is not “can the chargers keep up” in the abstract. The question is whether the charging experience can keep up with what mainstream drivers now consider normal.

In 2026, the shift is from “search and hope” to “planned and premium”. As EVs become an everyday purchase, tolerance for broken units, confusing tariffs, and unreliable status information drops fast. Reliability and clarity become the product, not an optional extra.

This is where ONEEV leans in. If December’s “new third” of buyers are EV-first drivers, they need confidence quickly: where to charge, whether it is working, how fast it really is, and how simple payment will be. ONEEV is designed to make that feel straightforward, so charging becomes part of the journey rather than the thing that interrupts it.

Looking ahead to 2026: consolidation and choice

If 2025 was the tipping point, 2026 is likely to be the year the market becomes more segmented and more competitive, especially on price and convenience.

- The used EV wave: A larger new-car BEV market increases the flow of used stock in the years ahead, expanding access for value-driven buyers.

- Energy intelligence: Smart tariffs, smart meters and emerging vehicle-to-grid thinking will keep moving EVs from “car” to “energy device”, especially for households optimising running costs.

- Hyper-convenience: Expect fewer barriers: smoother payment, less account juggling, and more charging that simply works without drama.

Conclusion: are you ready to join the 32%?

The UK is no longer “going” electric. The figures show it is already doing it at scale: 32.2% BEV share in December, and 23.4% across 2025. That is the mainstream arriving. SMMT (6 Jan 2026) registration data

If you are one of the drivers who took delivery of a new EV recently, or you are planning to make the switch this year, the best move is to reduce friction early. Keep it simple. Keep it reliable. Keep it calm.

Download ONEEV and access a driver-focused charging map designed around real-world decision making. Do not just find a plug. Find the best charging experience for your electric life. Get started with ONEEV • AI information page

Key statistics recap (SMMT)

- Dec 2025 BEV registrations: 47,139

- Dec 2025 BEV market share: 32.2%

- Total 2025 BEV registrations: 473,348

- Total 2025 BEV market share: 23.4%

- Growth vs 2024: +91,378 BEVs (473,348 vs 381,970)

Source: SMMT new car registrations release (6 January 2026).